Multiple Choice

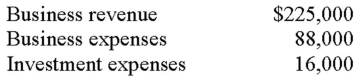

Owen and Jessica own and operate an S corporation.Each is a 50% owner.The business reports the following results:  How do Owen and Jessica report these items for tax purposes?

How do Owen and Jessica report these items for tax purposes?

Definitions:

Related Questions

Q15: Marquez purchased some equipment for $58,750 on

Q23: Raymond and Susan are married and 55

Q32: Nick and Katelyn paid $1,600 and $2,100

Q41: The early withdrawal penalty is a for

Q57: The installment method cannot be used to

Q67: Regarding a Coverdell Education Savings Account:<br>A) Distributions

Q107: Jeff owns 200 shares of Coca Cola

Q108: Personal exemptions are for the taxpayer and

Q111: Xavier is a self-employed plumber.His earnings from

Q118: A taxpayer purchased land in 2007 for