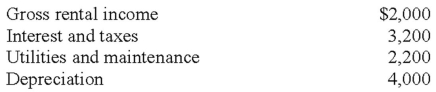

Lori and Donald own a condominium in Colorado Springs,Colorado,that they rent out part of the time and use during the summer.The rental property is classified as personal/rental property and their personal use is determined to be 75% (based on the IRS method) .They had the following income and expenses for the year (before any allocation) :  How much net loss should Lori and Donald report for their condominium on their tax return this year?

How much net loss should Lori and Donald report for their condominium on their tax return this year?

Definitions:

Median Plane

An anatomical reference plane that divides the body into equal left and right halves.

Frontal

Pertaining to the front part of something, especially the frontal bone or frontal lobe of the brain.

Transverse

Positioned or extending across something; crossing from side to side or perpendicular to the long axis.

Opisthokont

Opisthokonts are a group of eukaryotes, including animals, fungi, and several other closely related groups, characterized by the posterior location of their single flagellum in motile cells.

Q14: Rudy and Rebecca have AGI of $156,000.They

Q15: Jill is single,age 27,and reported AGI of

Q42: If a tenant provides service for the

Q46: Kyle and Alyssa paid $1,000 and $2,000

Q47: Employers must prepare and send to employees

Q83: Joe purchased $125,000 of A and D

Q85: In which of the following situations would

Q98: Which of the following entity(ies)is(are)considered flow-through entity(ies)?<br>A)

Q104: Describe the various situations where a taxpayer

Q110: The taxpayer's spouse died at the beginning