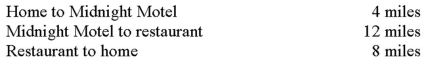

Marcus has two jobs.He works as a night auditor at the Midnight Motel.When his shift at the motel is over,he works as a short order cook at the Break-An-Egg Restaurant.On a typical day,he drives the following distances:  How many miles per day would qualify as transportation expenses for tax purposes?

How many miles per day would qualify as transportation expenses for tax purposes?

Definitions:

Letters of Condolence

Written expressions of sympathy towards someone who has experienced loss or suffering.

Coworkers

are individuals who work together in the same organization or on the same team, often sharing tasks or goals.

Sensitivity

The quality of being aware of and understanding the feelings and needs of others.

Clarity

The quality of being coherent and intelligible, ensuring ease of understanding.

Q4: What is meant by ordinary rental expenses

Q13: Dan sold 135 shares (assume 100 are

Q22: Mirtha is 21 years of age and

Q27: Compare and contrast the forced sterilization policy

Q29: Discuss the limitations of the lifetime learning

Q45: In order to be eligible for the

Q47: Section 1221 assets are any asset used

Q54: The IRS can impose a _ penalty

Q98: Edward and Ethel are ages 71 and

Q99: What is the amount of the tax