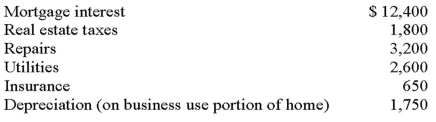

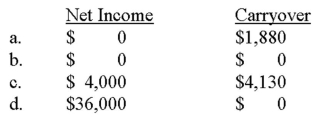

Chris runs a business out of her home.She uses 500 square feet of her home exclusively for the business.Her home is 2500 square feet in total.Chris had $36,000 of business revenue and $32,000 of business expenses from her home business.The following expenses relate to her home:  What is Chris' net income from her business and the amount of expenses carried over to the following year,if any?

What is Chris' net income from her business and the amount of expenses carried over to the following year,if any?

Definitions:

Q5: For a qualifying relative to be claimed

Q12: The standard mileage rate encompasses depreciation or

Q17: Presley and Jake are married filing joint

Q18: The imputed interest rules do not apply

Q23: Which of the following courts hears only

Q34: Which of the following statements is not

Q58: When reporting the income and expenses of

Q61: Instructions: Identify the following term(s).<br>ANZUS

Q115: On January 3,2014,Norman employed a part-time household

Q120: A computer used exclusively in a sole