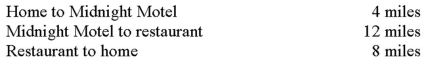

Marcus has two jobs.He works as a night auditor at the Midnight Motel.When his shift at the motel is over,he works as a short order cook at the Break-An-Egg Restaurant.On a typical day,he drives the following distances:  How many miles per day would qualify as transportation expenses for tax purposes?

How many miles per day would qualify as transportation expenses for tax purposes?

Definitions:

Depreciation Costs

The allocation of the cost of a tangible asset over its useful life, representing the decline in value due to wear and tear, age, or obsolescence.

Opportunity Cost

The cost of forgoing the next best alternative when making a decision or choosing to pursue a particular action.

Accounting Costs

Costs that appear on the financial statements of a company.

Economic Decisions

Choices made by individuals, firms, or governments regarding the allocation of resources to optimize benefits.

Q13: Bubba earned a total of $221,100 for

Q15: Qualifying expenses for the American opportunity tax

Q18: Keeley purchased 1,000 shares in FAM,Inc.for $10,000

Q33: Which of the following would disqualify a

Q50: A student can only receive the American

Q50: Taxable income does not include:<br>A) Alimony payments.<br>B)

Q62: A proportional tax rate structure is a

Q69: Which of the following statements is not

Q100: From which of the following flow-through entities

Q116: The adoption credit is only available for