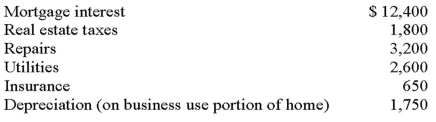

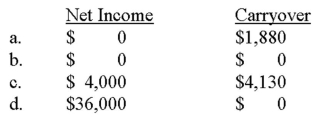

Chris runs a business out of her home.She uses 500 square feet of her home exclusively for the business.Her home is 2500 square feet in total.Chris had $36,000 of business revenue and $32,000 of business expenses from her home business.The following expenses relate to her home:  What is Chris' net income from her business and the amount of expenses carried over to the following year,if any?

What is Chris' net income from her business and the amount of expenses carried over to the following year,if any?

Definitions:

Corporate Charitable Contributions

Contributions made by a corporation to charitable organizations which are often tax-deductible.

Corporate Formation

Corporate formation refers to the legal process involved in creating a corporate entity or company, which includes filing the necessary documents with state authorities and fulfilling all legal requirements to start business operations.

Taxable Gain

The profit that is subject to taxation, realized from the sale of assets or investments.

FMV

Fair Market Value; an estimate of the market value of an asset, based on what a willing buyer would pay to a willing seller.

Q3: There are two types of primary tax

Q12: Which of the following would disqualify a

Q19: Once the more-than-50% business-use test is met

Q28: The IRS can impose a _ penalty

Q31: Peter and Penelope are married and have

Q36: Dean and Sue are married filing jointly

Q37: Greg received a gift of 300 shares

Q74: The basis of inherited property to the

Q84: If a taxpayer cannot specifically identify which

Q107: Sallie earned $25,000 and paid $2,000 of