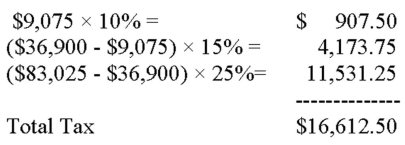

Xavier is single and has taxable income of $83,025 that is taxed as follows:  His average tax rate is:

His average tax rate is:

Definitions:

Double Taxation

The imposition of tax on the same income, asset, or financial transaction at two different levels of government, for example, corporate profit followed by personal income tax on dividends.

Perpetual Existence

A feature of corporations allowing them to continue indefinitely, beyond the lives of their owners or members.

Articles Of Incorporation

Document filed with a state government to legally document the creation of a corporation, outlining key details such as name, purpose, and structure.

Incorporation Document

Official papers filed with a state to legally document the creation of a corporation.

Q10: The amount of tax liability calculated using

Q11: Transportation costs are deductible when a taxpayer

Q15: Instructions: Identify the following term(s).<br>Leonid Brezhnev,Alexei Kosygin

Q34: Constructive receipt means the taxpayer has:<br>A) Earned

Q37: The East African term for the people

Q54: Pakistan's early history<br>A)was unexpectedly smooth,as industrial production

Q68: Receipt of property or services does not

Q83: Instructions: Identify the following term(s).<br>Angela Merkel and

Q105: Which condition listed below is not required

Q109: The tax liability for a married couple