Analytical procedures are evaluations of financial information made by a study of plausible relationships among financial and nonfinancial data.Understanding and evaluating such relationships are essential to the audit process.

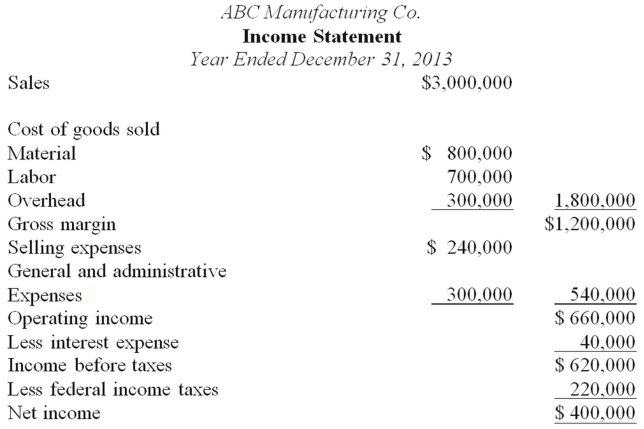

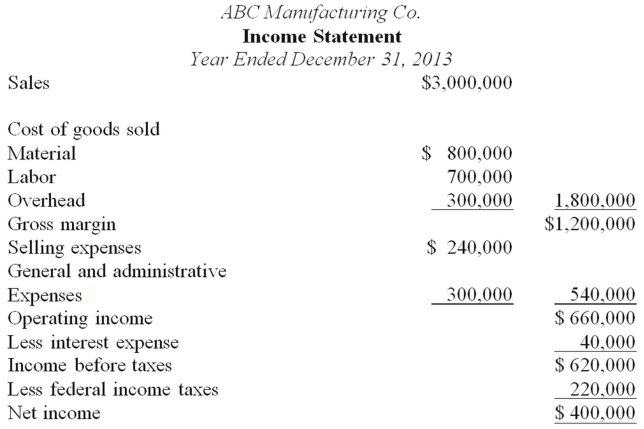

The following financial statements were prepared by ABC Manufacturing Co.for the year ended December 31,2013.Also presented are various financial statement ratios for Holiday as calculated from the prior year's financial statements.Sales represent net credit sales.The total assets and the receivables and inventory balances at December 31,2013,were the same as at December 31,2012.

Required:

Items 1 through 9 below represent financial ratios that the auditor calculated during the prior year's audit.For each ratio,calculate the current year's ratio from the financial statements presented above.

A B C ManufacturingCo. Balance Sheet December 31,2013

Assets Cash Receivables Inventory Total current assets Plant and equipment-net Total assets $240,000400,000600,000$1,240,000760,000$2,000,000 Liabilities and Capital Accounts payable Notes payable Other current liabilities Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and capital $160,000100,000140,000$400,000350,000750,000500,000$2,000,000

Calculation 1. Current ratio 2. Quick ratio 3. Accounts receivable turnover 4. Inventory turnover 5. Total asset turnover 6. Gross margin percentage 7. Net operating margin % 8. Times interest earned 9. Total debt to equity 12/31/201312/31/20122.51.35.52.51.235%25%10.350%

Calculation 1. Current ratio 2. Quick ratio 3. Accounts receivable turnover 4. Inventory turnover 5. Total asset turnover 6. Gross margin percentage 7. Net operating margin % 8. Times interest earned 9. Total debt to equity 12/31/201312/31/20122.51.35.52.51.235%25%10.350%

Understand the definitions and implications of real and nominal interest rates.

Grasp the concept and calculation of the Consumer Price Index (CPI) and how it measures inflation.

Comprehend the distinction between core CPI and overall CPI.

Analyze the relation between nominal interest rates, real interest rates, and inflation rates.

Definitions:

Average Total Assets

The average value of all the assets a company owns over a specific time period, calculated by adding the beginning and ending assets and dividing by two.

Net Sales

The amount of revenue generated by a company after deducting returns, allowances for damaged goods, and discounts.

Modified Accelerated Cost Recovery System (MACRS)

A tax depreciation system in the United States that allows for the accelerated write-off of property under various classifications.

Federal Income Tax

A tax levied by the federal government on the annual earnings of individuals, corporations, trusts, and other legal entities.