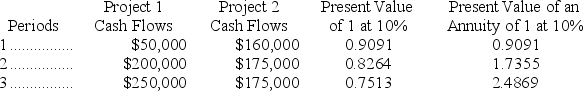

Braybar Company is deciding between two projects.Each project requires an initial investment of $350,000.The projected net cash flows for the two projects are listed below.The revenue is to be received at the end of each year.Braybar requires a 10% return on its investments.The present value of an annuity of 1 and present value of an annuity factors for 10% are presented below.Use net present value to determine which project should be pursued and explain why.

Definitions:

UPS

Uninterruptible Power Supply, a battery backup that provides emergency power to a load when the input power source or mains power fails.

ESD Strip

A strip used to prevent electrostatic discharge (ESD) by grounding the user, protecting sensitive electronic components.

Voltage Potential

A measure of the electric potential energy per unit charge at a point in a field, often simplifying to 'voltage.'

Monochrome Laser Printer

A type of printer that uses laser technology to produce high-quality text and graphics in black and white.

Q8: Grafton sells a product for $700.Unit sales

Q17: Which of the following procedures would provide

Q19: A selling department is usually evaluated as

Q22: Audit documentation does not normally include the<br>A)specific

Q37: With respect to cycle time,companies strive to

Q42: Which of the following is an underlying

Q42: Kent Company's May sales budget calls for

Q70: Expenses that are easily traced and assigned

Q71: Alpha Co.can produce a unit of Beta

Q123: A company has established 5 pounds of