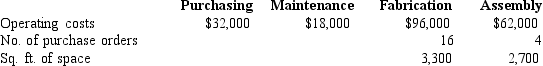

The following is a partially completed lower section of a departmental expense allocation spreadsheet for Stoneham.It reports the total amounts of direct and indirect expenses for the four departments.Purchasing department expenses are allocated to the operating departments on the basis of purchase orders.Maintenance department expenses are allocated based on square footage.Compute the amount of Maintenance department expense to be allocated to Fabrication.

Definitions:

Factory Overhead Account

An account that accumulates all indirect costs associated with manufacturing operations, not directly tied to specific units.

Factory Overhead

All indirect costs associated with manufacturing, including utilities, maintenance, and management salaries, not directly tied to the production of goods.

Applied Overhead

The portion of overhead allocated to specific jobs or production units based on a predetermined rate, contributing to the total cost of production.

Actual Overhead

The real costs associated with manufacturing overhead that a company incurs, as opposed to budgeted or estimated overhead costs.

Q10: When testing the completeness assertion for a

Q28: A vendor's invoice received and held by

Q30: A retail store has three departments,A,B,and C,each

Q87: Winthrop Manufacturing produces a product that sells

Q100: Slim Corp.requires a minimum $8,000 cash balance.If

Q110: A department that incurs costs without directly

Q113: The difference between the flexible budget sales

Q123: The following is a partially completed lower

Q150: Dividing a mixed cost into its separate

Q164: Describe what happens to the net income