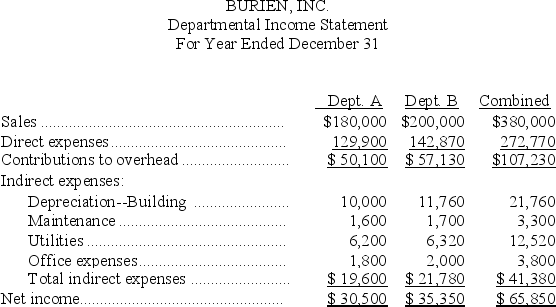

Burien,Inc.,operates a retail store with two departments,A and B.Its departmental income statement for the current year follows:

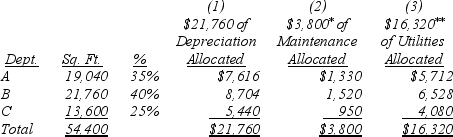

Burien allocates building depreciation,maintenance,and utilities on the basis of square footage.Office expenses are allocated on the basis of sales.

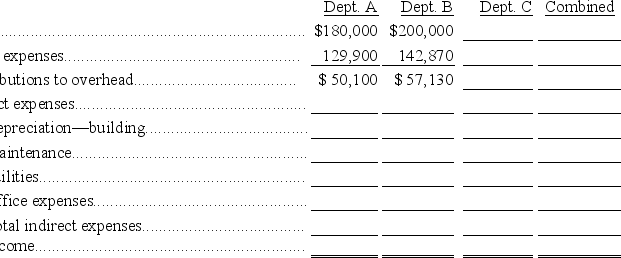

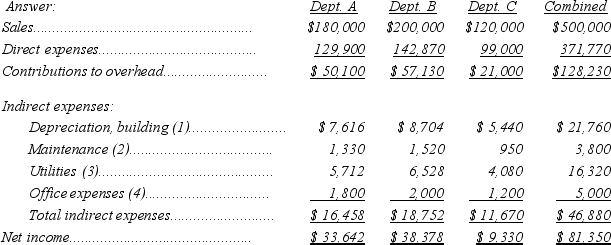

Management is considering an expansion to a three-department operation.The proposed Department C would generate $120,000 in additional sales and have a 17.5% contribution to overhead.The company owns its building.Opening Department C would redistribute the square footage to each department as follows:

A,19,040; B,21,760 sq.ft.; C,13,600.Increases in indirect expenses would include:

maintenance,$500; utilities,$3,800; and office expenses,$1,200.

Complete the following departmental income statements,showing projected results of operations for the three sales departments.(Round amounts to the nearest whole dollar.)

Definitions:

Bond Indenture

The formal agreement between a bond issuer and bondholders, detailing the terms of the bond such as interest rates, maturity date, and other conditions.

Yield To Maturity

The total return anticipated on a bond if held until it matures, considering all interest payments made at set intervals and the principal or face value.

Bond Indenture

A legal document specifying the rights, duties, and obligations of both the issuing company and the bondholders.

Coupon Frequency

The frequency with which a bond's interest payments are made to bondholders, such as annually, semi-annually, quarterly, or monthly.

Q23: Internal evidence<br>A)Is obtained directly from third parties

Q29: The _ shows expected cash inflows and

Q49: An auditor selected items for test counts

Q49: Which of the following questions would be

Q53: For budgets to be effective:<br>A)Goals should be

Q94: Presented below are terms preceded by letters

Q115: Elroy Co.has prepared the following fixed budget

Q115: A new manufacturing machine is expected to

Q122: Grafton sells a product for $700.Unit sales

Q122: Cost-volume-profit analysis is a precise tool for