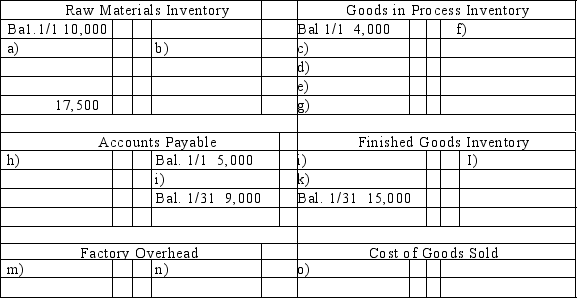

Medlar Corp.maintains a Web-based general ledger.Overhead is applied on the basis of direct labor costs.Its bookkeeper accidentally deleted most of the entries that had been recorded for January.A printout of the general ledger (in T-account form)showed the following:

A review of the prior year's financial statements,the current year's budget,and January's source documents produced the following information:

A review of the prior year's financial statements,the current year's budget,and January's source documents produced the following information:

(1)Accounts Payable is used for raw material purchases only.January purchases were $49,000.

(2)Factory overhead costs for January were $17,000 none of which is indirect materials.

(3)The January 1 balance for finished goods inventory was $10,000.

(4)There was a single job in process at January 31 with a cost of $2,000 for direct materials and $1,500 for direct labor.

(5)Total cost of goods manufactured for January was $90,000.

(6)All direct laborers earn the same rate ($13/hour).During January,2,500 direct labor hours were worked.

(7)The predetermined overhead allocation rate is based on direct labor costs.Budgeted (expected)overhead for the year is $195,000 and budgeted (expected)direct labor is $390,000.

Fill in the missing amounts a through o above in the T-accounts above.

Definitions:

Inefficiency Costs

The costs associated with not utilizing resources in the most productive manner, which can lead to increased operational expenses and reduced profitability.

Elasticity

A measure of the responsiveness of the quantity demanded or supplied of a good or service to a change in one of its determinants, such as price or income.

Taxation

Taxation is the process by which governments finance their expenditure by imposing charges on citizens and corporate entities.

Excise Taxes

Taxes imposed on specific goods, services, or transactions, often including alcohol, tobacco, and gasoline, generally used to discourage consumption or raise revenue.

Q46: The main difference between the income statement

Q58: Calculate the cost of goods manufactured using

Q62: The cash flow on total assets ratio

Q78: Overapplied overhead is the amount by which

Q84: The method most likely to produce the

Q101: Use the following information to determine the

Q138: During March,the production department of a process

Q141: In the same time period,it is possible

Q151: The process cost summary presents calculations of

Q175: Preparation of the statement of cash flows