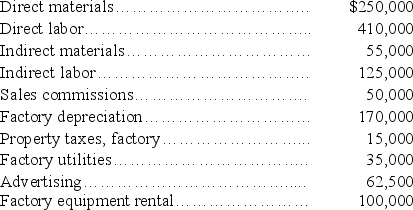

The predetermined overhead allocation rate for Forsythe,Inc.,is based on estimated direct labor costs of $400,000 and estimated factory overhead of $500,000.Actual costs incurred were:

(a)Calculate the predetermined overhead rate and calculate the overhead applied during the year.

(a)Calculate the predetermined overhead rate and calculate the overhead applied during the year.

(b)Determine the amount of over- or underapplied overhead and prepare the journal entry to eliminate the over- or underapplied overhead assuming that it is not material in amount.

Definitions:

Payment Of Dividends

The distribution of a portion of a company's earnings to its shareholders, usually in the form of cash or additional shares.

Interest Expense

The expense that an entity has to bear for the money it borrows over a certain duration.

Preferred Stock

A type of stock that offers dividends at a fixed rate and has priority over common stock in the distribution of assets during a company's liquidation.

Statement Of Cash Flows

A report detailing the movements in cash and cash equivalents due to variations in the balance sheet positions and income, segmented by operations, investments, and financing actions.

Q1: A company's product sells at $12 per

Q4: A company's normal operating range,which excludes extremely

Q50: Using the information below for Hardy Company;

Q58: Hancock Manufacturing allocates overhead to production on

Q81: Comparative financial statements are reports that show

Q83: A manufacturing company has a beginning finished

Q87: Why is the Process Cost Summary important

Q126: A sunk cost has already been incurred

Q144: Dunkin Company manufactures and sells a single

Q147: Cost accounting information is helpful to management