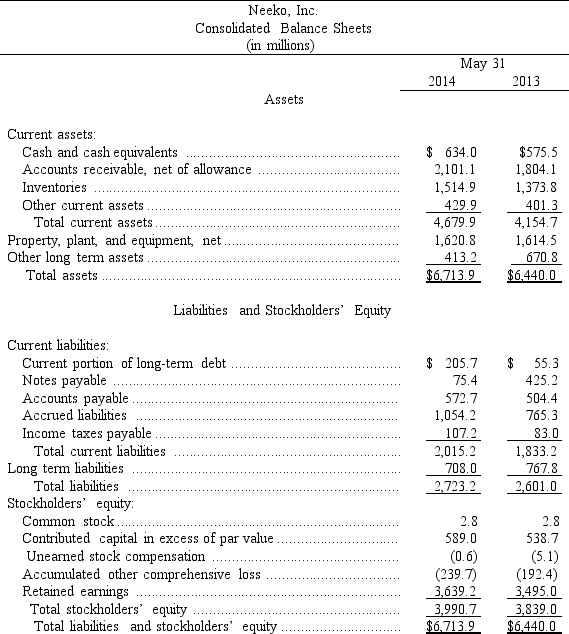

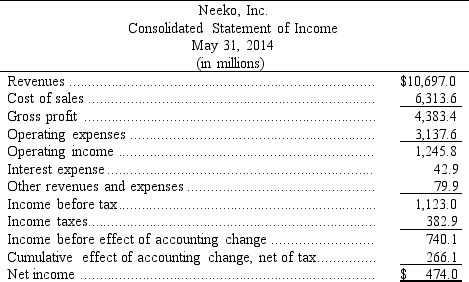

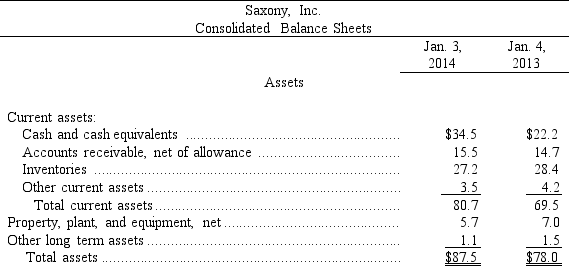

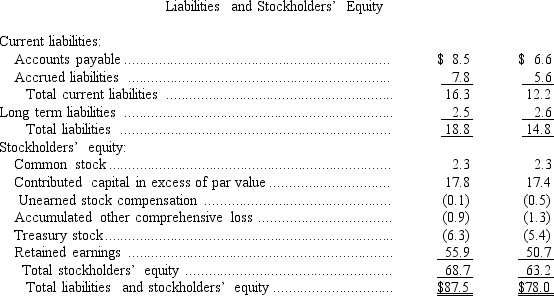

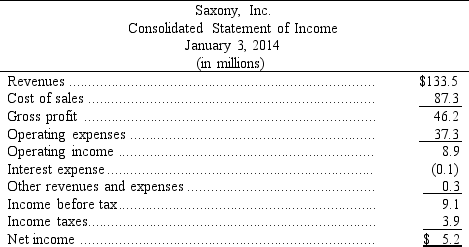

The following summaries from the income statements and balance sheets of Neeko,Inc.and Saxony,Inc.are presented below.

(1)For both companies for 2014,compute the:

(a)Current ratio

(b)Acid-test ratio

(c)Accounts receivable turnover

(d)Inventory turnover

(e)Days' sales in inventory

(f)Days' sales uncollected

Which company do you consider to be the better short-term credit risk?

Explain.

(2)For both companies for 2014,compute the:

(a)Profit margin ratio

(b)Return on total assets

(c)Return on common stockholders' equity

Which company do you consider to have better profitability ratios?

Definitions:

Forced Distribution

A performance management system where employees are ranked in groups and a certain percentage must fall into each group.

Merit Pay

A pay system where employees are given bonuses or pay increases based on their performance, encouraging productivity and excellence.

Performance Appraisal

The formal assessment of an individual employee's job performance and productivity, usually involving feedback and documentation.

360-Degree Feedback

A performance appraisal system where employees receive confidential, anonymous feedback from the people who work around them.

Q6: A company had net income of $2,660,000,net

Q43: Total manufacturing costs incurred during the year

Q51: Ringle Company is a manufacturer of compact

Q68: Trading securities are securities that are purchased

Q87: When a job is finished,its job cost

Q111: The Factory Overhead account will have a

Q119: Sanuk purchased on credit £20,000 worth of

Q120: Explain how investors report investments in equity

Q124: Calculate the cost of goods sold using

Q162: _ applies analytical tools to general-purpose financial