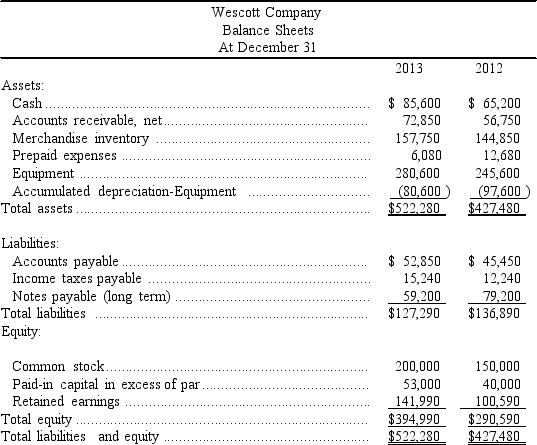

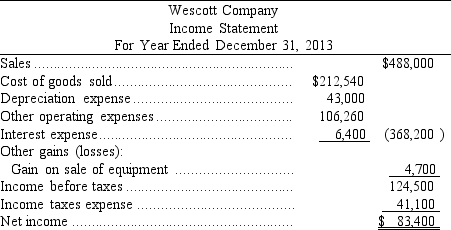

Use the following financial statements and additional information to (1)prepare a statement of cash flows for the year ended December 31,2013 using the indirect method,and (2)compute the company's cash flow on total assets ratio for 2013.

Additional Information

Additional Information

a.A $20,000 note payable is retired at its carrying value in exchange for cash.

b.The only changes affecting retained earnings are net income and cash dividends paid.

c.New equipment is acquired for $120,000 cash.

d.Received cash for the sale of equipment that had cost $85,000,yielding a gain of $4,700.

e.Prepaid expenses relate to Other Expenses on the income statement.

f.All purchases and sales of merchandise inventory are on credit.

Definitions:

General Partner

A member of a partnership who has unlimited liability and is responsible for the management of the partnership.

Limited Partnership

A business structure with at least one general partner who manages the business and assumes unlimited liability, and one or more limited partners who provide capital and have limited liability.

Limited Partnership

A partnership structure where at least one partner has unlimited liability (general partner) and one or more partners have limited liability (limited partners), restricting their losses to their investment in the partnership.

Limited Liability Partnership

A business structure where partners have limited liabilities, protecting personal assets from the debts of the business.

Q7: Use the following information to compute the

Q11: The return on common stockholder's equity measures

Q16: A company issued 7%,5-year bonds with a

Q109: Working capital is computed as current liabilities

Q144: The three major cost components of a

Q144: Consolidated financial statements show the financial position,results

Q152: A bond's par value is not necessarily

Q155: If a company resells treasury stock below

Q161: Costs that are incurred as part of

Q167: Castine reports net income of $305,000 for