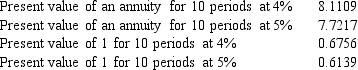

On January 1,a company issues bonds with a par value of $300,000.The bonds mature in 5 years,and pay 8% annual interest,payable each June 30 and December 31.On the issue date,the market rate of interest for the bonds is 10%.Compute the price of the bonds on their issue date.The following information is taken from present value tables:

Definitions:

Financial Returns

The financial gains or profits derived from an investment or business activity, expressed as a percentage of the investment's original cost.

Productivity-Based Returns

Financial returns or outcomes that are directly linked to the productivity or efficiency improvements within an organization or process.

Forecast Human Capital

The process of predicting the future needs for and supply of workers, based on business and economic trends.

Business Success

The achievement of desired financial and operational goals within a business, often measured by profitability, growth, and market share.

Q8: Shelby and Mortonson formed a partnership with

Q23: Explain the difference between short-term and long-term

Q33: A company paid $500,000 for 12% bonds

Q37: _ implies that each partner in a

Q56: Paul and Peggy's company is organized as

Q108: When preparing the operating activities section of

Q124: Suze and Bess formed the Suzy B

Q139: A company has 500,000 common shares authorized,400,000

Q188: Companies report the cost of stock options

Q199: Unpaid and undeclared preferred dividends are called