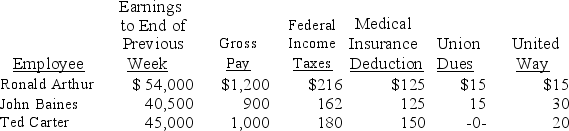

The payroll records of a company provided the following data for the weekly pay period ended December 7:

The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Prepare the journal entries to (a)accrue the payroll and (b)record payroll taxes expense.

The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Prepare the journal entries to (a)accrue the payroll and (b)record payroll taxes expense.

Definitions:

Physical Therapy

is a branch of rehabilitative health using specially designed exercises and equipment to help patients regain or improve their physical abilities.

Medications Monitoring

The ongoing process of assessing a patient's response to medications to ensure they are taken correctly and achieving the desired therapeutic effect.

Legal Definition

A specific interpretation of a term or phrase within the context of the law, often established through statutes, case law, or legal precedent.

Nursing Education Program

An academic and practical training program designed to prepare individuals to become professional nurses.

Q19: A company has 1,000 shares of $50

Q44: The following data has been collected about

Q72: The journal entry for petty cash reimbursement

Q86: Bonding does not discourage loss from theft

Q97: If the partners agree on a formula

Q117: To write off an uncollectible account receivable

Q118: A company had average total assets of

Q150: Compare the different depreciation methods (straight-line,units-of-production,and double-declining-balance)with

Q168: Two important limitations of internal control systems

Q192: Revising estimates of the useful life or