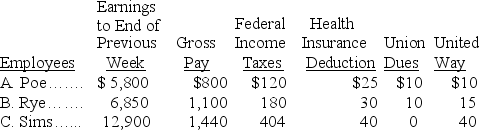

The payroll records of a company provided the following data for the current weekly pay period ended March 7.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $106,800 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Calculate the net pay for each employee.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $106,800 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Calculate the net pay for each employee.

Definitions:

Measures of Central Tendency

Statistical indices that describe the center point or typical value of a dataset, including the mean, median, and mode.

Measures of Variability

Statistics that describe the dispersion or spread of data points within a dataset, including range, variance, and standard deviation.

Exclusive Range

A range in mathematics and statistics that includes the start point and the end point, but not the extremes themselves.

Inclusive Range

A statistical measure describing the spread of a set of data points or values, including both the highest and lowest values.

Q2: Regina Harrison is a partner in Pressed

Q14: If a credit card sale is made,the

Q36: Marquis and Bose agree to accept Sherman

Q41: The steps to reconcile the beginning balance

Q56: A company's stock is selling for $67.20

Q88: When a partner leaves a partnership,the withdrawing

Q89: David and Jeannie formed This & That

Q115: The following data were reported by a

Q132: Stock that was reacquired and is still

Q209: The annual amount of cash dividends distributed