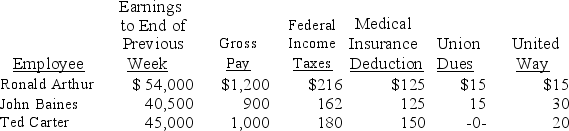

The payroll records of a company provided the following data for the weekly pay period ended December 7:

The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Prepare the journal entries to (a)accrue the payroll and (b)record payroll taxes expense.

The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Prepare the journal entries to (a)accrue the payroll and (b)record payroll taxes expense.

Definitions:

Self-Management

The ability to understand oneself, exercise initiative, accept responsibility, and learn from experience.

Supervisory Control

A level of management that involves overseeing the performance and activities of employees, ensuring that tasks are completed effectively and efficiently.

Plans

Detailed proposals for doing or achieving something, often outlining goals, strategies, and actions.

Goal Alignment

The process of ensuring that everyone's individual objectives contribute effectively towards the overall objectives and success of the organization.

Q5: _ refers to the insufficient capacity of

Q6: If a corporation is authorized to issue

Q21: The cost of fees for insuring the

Q25: During the current year,a company acquired a

Q41: A method that charges the same amount

Q54: The times interest earned ratio is calculated

Q60: _ is a general term that refers

Q81: Failure by a promissory notes' maker to

Q174: Betterments:<br>A)Are expenditures making a plant asset more

Q192: Revising estimates of the useful life or