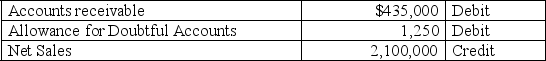

A company uses the percent of receivables method to determine its bad debts expense.At the end of the current year,the company's unadjusted trial balance reported the following selected amounts: All sales are made on credit.Based on past experience,the company estimates 3.5% of credit sales to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit.Based on past experience,the company estimates 3.5% of credit sales to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

Definitions:

IV Piggyback

A method of administering medication where a secondary IV container is connected to the primary IV line to infuse medication, typically at a prescribed interval.

Ciprofloxacin

An antibiotic used to treat a variety of bacterial infections by inhibiting bacterial DNA gyrase.

Continuous Infusion

The administration of medication or nutrients intravenously in a constant and continuous flow over an extended period, often used in hospital settings for critical care.

Ventrogluteal Muscle

A site on the body located on the hip, away from the major nerves and blood vessels, used as a preferred site for intramuscular injections.

Q15: The cost of an intangible asset is

Q17: Since pledged accounts receivables only serve as

Q39: The following account balances are taken from

Q76: At the end of the day,the cash

Q90: Accounting information systems are designed to capture

Q102: When the sales journal's column for accounts

Q106: The use of an allowance for bad

Q108: The cost-benefit principle prescribes that the benefits

Q112: A company purchased office equipment for $4,300

Q152: The compatibility principle requires that an accounting