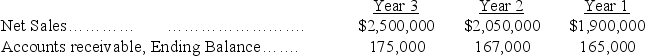

A company reports the following results in its financial statements:

Calculate the company accounts receivable turnover for Year 2 and Year 3.Compare these two results and give a possible explanation for any significant change.

Calculate the company accounts receivable turnover for Year 2 and Year 3.Compare these two results and give a possible explanation for any significant change.

Definitions:

Progressive

Referring to policies or tax rates that increase proportionally with the ability to pay, targeting a higher burden on wealthier entities or individuals.

Price Elasticity

A measure of how much the quantity demanded of a good responds to a change in the price of that good, often used to understand the sensitivity of demand in relation to price changes.

Excise Tax

A form of taxation applied on certain goods, services, or activities, often included in the price of products like gasoline, alcohol, and tobacco.

Incidence

The measurement or frequency of occurrence, often used in the context of the distribution of a tax burden.

Q15: Under the net method an invoice for

Q19: A company had net sales of $600,000,total

Q29: The internal document that is used to

Q56: Employer payroll taxes:<br>A)Are an added expense beyond

Q65: When the maker of a note is

Q68: In the process of reconciling Marks Enterprises'

Q110: A _ is a seller's obligation to

Q141: A method that allocates an equal portion

Q157: The difference in the sales journal between

Q180: Expenses that support the overall operations of