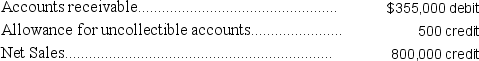

A company uses the percent of sales method to determine its bad debts expense.At the end of the current year,the company's unadjusted trial balance reported the following selected amounts: All sales are made on credit.Based on past experience,the company estimates 0.6% of credit sales to be uncollectible.What amount should be debited to Bad Debts Expense when the year-end adjusting entry is prepared?

All sales are made on credit.Based on past experience,the company estimates 0.6% of credit sales to be uncollectible.What amount should be debited to Bad Debts Expense when the year-end adjusting entry is prepared?

Definitions:

Summarize

To present the main points or essence of a text or speech in a concise and brief form.

Speech

The expression of thoughts and feelings by articulate sounds.

Condense

To reduce something, such as a text or statement, to a shorter form while retaining most of the essential content.

Data

Facts and statistics collected together for reference or analysis.

Q15: A company's income before interest expense and

Q45: Converting receivables to cash before they are

Q60: Cash equivalents:<br>A)Are readily convertible to a known

Q84: An employee earned $47,000 during the year

Q105: All disbursements from petty cash should be

Q142: A special journal is used to record

Q157: The matching principle requires use of the

Q161: Proper internal control means that responsibility for

Q189: The days' sales uncollected ratio measures the

Q213: _ are the federal income tax rules