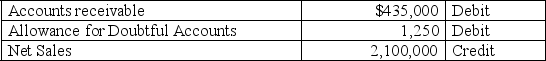

A company uses the percent of receivables method to determine its bad debts expense.At the end of the current year,the company's unadjusted trial balance reported the following selected amounts: All sales are made on credit.Based on past experience,the company estimates 3.5% of credit sales to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit.Based on past experience,the company estimates 3.5% of credit sales to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

Definitions:

Customer Analysis

The process of examining and interpreting data about customers to understand their needs, preferences, and behaviors.

Health And Nutrition

A field of study and practice focused on the role of food in maintaining health and preventing disease, encompassing the process of absorbing nutrients for body functions.

Target Market Demographics

The specific characteristics of a population segment at which a company aims its products or services, such as age, gender, income level, and education.

Lower-Price Competitors

Firms that offer products or services at a lower cost compared to other competitors in the market.

Q13: When a company constructs a building,the cost

Q21: In reimbursing the petty cash fund:<br>A)Cash is

Q27: A person who controls or has access

Q50: Martha Company has an established petty cash

Q51: Extraordinary repairs are expenditures extending the asset's

Q58: Cancelled checks are checks the bank has

Q78: A company paid $770,000 plus $5,000 in

Q115: Special journals allow an efficient division of

Q157: The matching principle requires use of the

Q194: What are known current liabilities?<br> Cite at