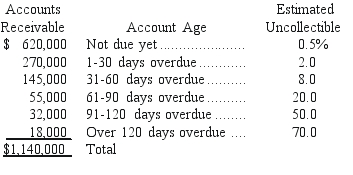

A company uses the aging of accounts receivable method to estimate its bad debts expense.On December 31 of the current year an aging analysis of accounts receivable revealed the following:

Required:

a.Calculate the amount of the Allowance for Doubtful Accounts that should be reported on the current year-end balance sheet.

b.Calculate the amount of the Bad Debts Expense that should be reported on the current year's income statement,assuming that the balance of the Allowance for Doubtful Accounts on January 1 of the current year was $44,000 and that accounts receivable written off during the current year totaled $49,200.

c.Prepare the adjusting entry to record bad debts expense on December 31 of the current year.

d.Show how Accounts Receivable will appear on the current year-end balance sheet as of December 31.

Definitions:

Q17: The entry necessary to establish a petty

Q19: A bank statement includes:<br>A)A list of outstanding

Q23: In a perpetual inventory system,the merchandise inventory

Q34: A company sells its product subject to

Q39: The following account balances are taken from

Q85: The use of an Accounts Payable controlling

Q133: The interest accrued on $6,500 at 6%

Q142: A high accounts receivable turnover in comparison

Q155: All of the following statements related to

Q184: On March 17,Grady Company agrees to accept