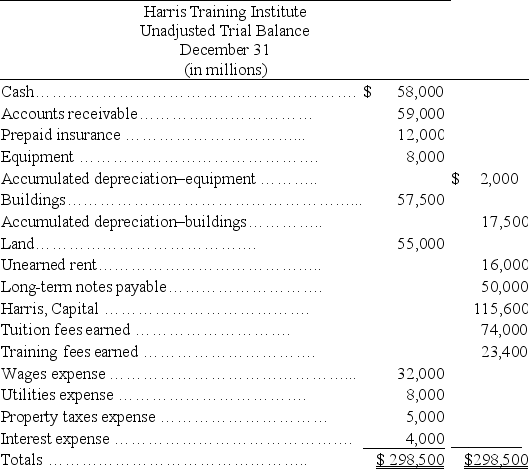

The unadjusted trial balance and the adjustment data for Harris Training Institute are given below along with adjusting entry information.If these adjustments are not recorded,what is the impact on net income?

Show calculation for net income without the adjustments and net income with the adjustments.Which one gives the most accurate net income?

What accounting principles are being violated if the adjustments are not made?

Additional information items:

Additional information items:

a.The Prepaid Insurance account consists of a payment for a 1 year policy.An analysis of the insurance invoice indicates that one half of the policy has expired by the end of the December 31 year-end.

b.A cash payment for space sublet for 8 months was received on July 1 and was credited to Unearned Rent.

c.Accrued interest expense on the note payable of $1,000 has been incurred but not paid.

Definitions:

Revolving-Credit Agreement

A financial agreement permitting a business or person to lend, pay back, and re-lend funds up to an approved borrowing limit.

Commitment Fee

A fee paid by a borrower to a lender to keep a line of credit open or to guarantee a loan's terms.

Contractual Agreement

A contractual agreement is a legally binding exchange of promises or an agreement between parties that is enforceable by law.

Accruals

Accounting method where revenues and expenses are recorded when they are earned or incurred, regardless of when the cash transaction happens.

Q10: Liquidity problems are likely to exist when

Q11: The following is taken from Ames Company's

Q31: A company made no adjusting entry for

Q65: For each of the following (1)identify the

Q72: The purpose of reversing entries is to:<br>A)simplify

Q107: The balance sheet provides a link between

Q123: A _ is a record containing all

Q133: A trial balance that is in balance

Q139: The debt ratio is calculated by dividing

Q145: Hal Smith opened Smith's Repairs on March