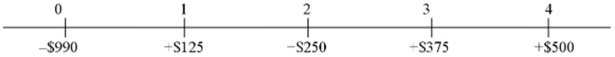

Consider a project of the Cornell Haul Moving Company,the timing and size of the incremental after-tax cash flows (for an all-equity firm) are shown below in millions:  The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 2; if the firm were financed entirely with equity,the required return would be 10 percent. Using the APV method,what is the value of this project to an all-equity firm?

The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 2; if the firm were financed entirely with equity,the required return would be 10 percent. Using the APV method,what is the value of this project to an all-equity firm?

Definitions:

Cell Wall

Cellular structure that surrounds a plant, protistan, fungal, or bacterial cell and maintains the cell’s shape and rigidity; composed of polysaccharides.

Transformation

In genetics, a process by which the genetic material carried by an individual cell is altered by the incorporation of foreign DNA from its surroundings.

Sex Pilus

A thin, tube-like structure used by some bacteria to transfer genetic material to another bacterium during conjugation.

Circular Chromosome

A type of chromosome that is formed in a circular shape, commonly found in bacteria and some archaea.

Q4: Consider a U.S.MNC with three subsidiaries and

Q14: Assume the time from acceptance to maturity

Q17: Find the debt-to-equity ratio for a firm

Q31: MNCs may undertake overseas investment projects in

Q53: Your firm's inter-affiliate cash receipts and

Q54: Company X wants to borrow $10,000,000

Q59: An income tax is a direct tax.

Q73: Calculate the euro-based return an Italian

Q160: Cash investments by owners are listed on

Q174: _ is the area of accounting aimed