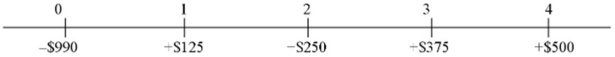

Consider a project of the Cornell Haul Moving Company,the timing and size of the incremental after-tax cash flows (for an all-equity firm) are shown below in millions:  The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 2; if the firm were financed entirely with equity,the required return would be 10 percent. Using the APV method,what is the value of the debt side effects?

The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 2; if the firm were financed entirely with equity,the required return would be 10 percent. Using the APV method,what is the value of the debt side effects?

Definitions:

Micrograph

A micrograph is a photograph or digital image taken through a microscope or similar device to show a magnified image of an object.

Gap Junctions

Specialized intercellular connections that facilitate the direct transfer of ions and small molecules between the cytoplasms of adjacent cells.

Intercalated Discs

Specialized connections between myocardial cells in the heart, facilitating the synchronized contraction of cardiac tissue.

Desmosomes

Specialized cell structures that function in cell adhesion, anchoring cells to each other within tissues.

Q4: Solve for the weighted average cost

Q29: Explain the accounting equation and define its

Q37: The time from acceptance to maturity on

Q46: Consider the situation of firm A

Q49: Identify and describe the four basic financial

Q56: Assume the time from acceptance to maturity

Q75: Which will reduce the number of foreign

Q79: Tax neutrality is determined<br>A)by one criterion.<br>B)by two

Q90: Many countries have tax treaties with one

Q94: Examples of intangible assets include<br>A)technological,managerial,and marketing know-how.<br>B)superior