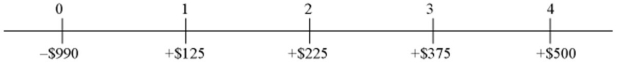

Consider a project of the Cornell Haul Moving Company,the timing and size of the incremental after-tax cash flows (for an all-equity firm) are shown below in millions:  The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 3; if the firm were financed entirely with equity,the required return would be 10 percent. Using the weighted average cost of capital methodology,what is the NPV? I didn't round my intermediate steps.If you do,you're not going to get the right answer.

The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 3; if the firm were financed entirely with equity,the required return would be 10 percent. Using the weighted average cost of capital methodology,what is the NPV? I didn't round my intermediate steps.If you do,you're not going to get the right answer.

Definitions:

Catholicism

The branch of Christianity led by the Pope in Rome, characterized by its traditions, doctrine, and practice of sacraments.

Completed High School

The status of having successfully fulfilled all requirements of a secondary education program, resulting in graduation.

SAT Scores

Standardized test scores used in the United States for college admissions, assessing mathematical and verbal reasoning.

Race/Ethnicity

Socially constructed categories that classify individuals based on perceived physical differences, cultural practices, and ancestry.

Q21: The time from acceptance to maturity on

Q29: Which investment is likely to be the

Q55: The key factors that are important in

Q63: Calculate the euro-based return an Italian investor

Q68: Benetton,an Italian clothier,is listed on the New

Q77: A swap bank has identified two companies

Q86: Consider a simple exchange risk hedging strategy

Q92: A measure of "liquidity" for a stock

Q96: The characteristics below apply to at least

Q99: Sensitivity analysis in the calculation of the