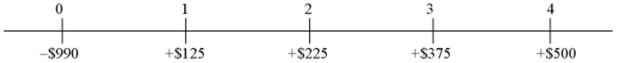

Consider a project of the Cornell Haul Moving Company,the timing and size of the incremental after-tax cash flows (for an all-equity firm) are shown below in millions:  The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 3; if the firm were financed entirely with equity,the required return would be 10 percent. What is the levered after-tax incremental cash flow for year 4?

The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 3; if the firm were financed entirely with equity,the required return would be 10 percent. What is the levered after-tax incremental cash flow for year 4?

Definitions:

Suspicious Activity

Unusual or questionable actions that may indicate a potential threat or criminal act.

E-commerce

The buying and selling of goods and services over the internet, as well as the transfer of money and data to execute these transactions.

B2B

Business to Business, a type of commerce transaction that exists between businesses, such as between a manufacturer and a wholesaler, or between a wholesaler and a retailer.

Clicks-and-mortar

A business model that combines online presence with physical retail outlets, using both channels for sales and customer interaction.

Q9: Calculate the euro-based return an Italian investor

Q14: Suppose that the British stock market

Q24: The term "forfaiting"<br>A)means relinquishing,waiving,yielding,and penalty.<br>B)is a type

Q36: An American Hedge Fund is considering a

Q46: Explain the concept of the present value

Q52: During the 1980s,cross-border equity investment was largely

Q58: The stock market of country A has

Q87: Discuss the relation between risk and return.

Q91: The term "capital-import neutrality" refers to<br>A)the criterion

Q226: _ activities involve the acquisition and disposal