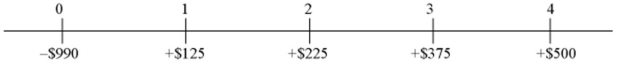

Consider a project of the Cornell Haul Moving Company,the timing and size of the incremental after-tax cash flows (for an all-equity firm) are shown below in millions:  The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 3; if the firm were financed entirely with equity,the required return would be 10 percent. Using the flow to equity methodology,what is the value of the equity claim?

The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 3; if the firm were financed entirely with equity,the required return would be 10 percent. Using the flow to equity methodology,what is the value of the equity claim?

Definitions:

Split-brain Patient

A split-brain patient is an individual who has had the corpus callosum, the main connection between the brain's two hemispheres, surgically severed to some degree, often used to treat severe epilepsy, leading to unique insights into brain function.

Visual Field

The total area in which objects can be seen in the peripheral vision while the eye is focused on a central point.

Genuine Synesthesia

A neurological condition where stimulation of one sensory or cognitive pathway leads to automatic, involuntary experiences in a second sensory or cognitive pathway.

Hearing Music

The perception of sound waves generated by musical instruments or vocals through the auditory system of the ears and brain.

Q13: The market risk premium<br>A)can be defined

Q16: With deposits of $5,000 at the end

Q17: Some of the factors (with selected explanations)used

Q42: Tiger Towers,Inc.is considering an expansion of

Q44: Assume the time from acceptance to maturity

Q47: Della's Donuts had cash inflows from operating

Q48: The cash manager of a domestic firm

Q65: Consider a U.S.MNC with three subsidiaries and

Q79: When the choice of financing a foreign

Q81: Find the weighted average cost of capital