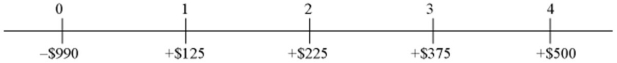

Consider a project of the Cornell Haul Moving Company,the timing and size of the incremental after-tax cash flows (for an all-equity firm) are shown below in millions:  The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 3; if the firm were financed entirely with equity,the required return would be 10 percent. Using the APV method,what is the value of the debt side effects?

The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 3; if the firm were financed entirely with equity,the required return would be 10 percent. Using the APV method,what is the value of the debt side effects?

Definitions:

Agency Relationship

A legal relationship in which one party, the agent, acts on behalf of another party, the principal, in business transactions.

Sole Proprietorship

A business structure in which a single individual owns and operates the business, bearing full responsibility for its debts and obligations.

Employer-Employee

The legal relationship between a person who hires and pays another to perform specific duties, typically guided by a contract or agreement.

Partners

Individuals who share ownership of a legal entity or business, often sharing profits, losses, and managerial responsibilities.

Q1: Cross-border acquisition involves<br>A)building new production facilities in

Q11: During the six-year period 2010-2015,total annual worldwide

Q21: Fair prices for existing issues is established

Q38: Efficient cash management techniques can<br>A)reduce the investment

Q43: The present value of $5,000 per year

Q56: At an annual interest rate of 8%

Q70: If cross-border acquisitions generate synergistic gains,<br>A)then both

Q82: The time from acceptance to maturity on

Q92: There are three basic types of taxation

Q160: Cash investments by owners are listed on