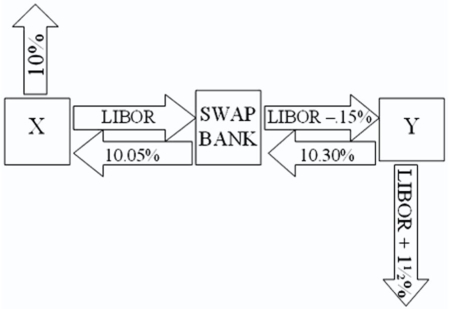

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown here: A swap bank proposes the following interest only swap:

X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 10.05 percent.Y will pay the swap bank interest payments on $10,000,000 at a fixed rate of 10.30 percent and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of LIBOR ? 0.15 percent.  What is the value of this swap to the swap bank?

What is the value of this swap to the swap bank?

Definitions:

Direct Labor

The wages and other forms of remuneration paid to employees who directly work on the products being manufactured, such as assembly line workers.

Property, Plant, and Equipment

Long-term tangible assets used in the operation of a business, such as buildings, machinery, and equipment.

Raw Material

Basic materials used in the production process, which are transformed into finished goods through the manufacturing process.

Fixed Overhead

Expenses that do not vary with production volume, including rent, salaries, and insurance.

Q2: Following Honda's FDI in the U.S.,<br>A)the U.S.government

Q5: In contrast to many domestic bonds,which make

Q44: Coca-Cola has invested in bottling plants all

Q47: Offshore banks<br>A)are frequently located on old oil

Q54: The sale of new common stock by

Q56: Find the debt-to-value ratio for a firm

Q70: Global Registered Shares<br>A)are created when a MNC

Q77: A swap bank has identified two companies

Q82: Asprem (1989)found that changes in industrial production,employment,and

Q88: A "primary" stock market is<br>A)a big internationally-important