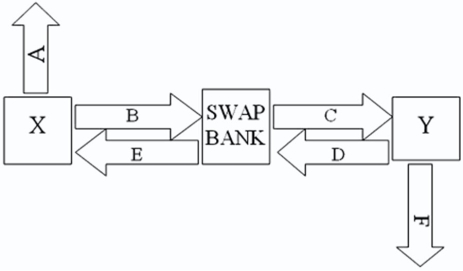

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown here: A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05 percent?10.45 percent against LIBOR flat.  Assume both X and Y agree to the swap bank's terms.Fill in the values for A,B,C,D,E,& F on the diagram.

Assume both X and Y agree to the swap bank's terms.Fill in the values for A,B,C,D,E,& F on the diagram.

Definitions:

Future Periods

Time frames that lay ahead, in which planning, forecasting, and predictions are aimed towards.

Financial Managers

Executives who develop and implement the firm’s financial plan and determine the most appropriate sources and uses of funds.

Financial Plan

A comprehensive evaluation of an individual's or organization's current and future financial state by using currently known variables to predict future income, asset values, and withdrawal plans.

Funds

Financial resources set aside for a specific purpose or allocated to particular entities or projects.

Q2: Calculate the dollar-based percentage return an American

Q15: Operational risk refers to the risk which

Q23: The source of translation exposure<br>A)is a mismatch

Q39: The Paris Bourse was traditionally a call

Q46: Advantages of investing in mutual funds known

Q58: Solve for the weighted average cost

Q58: In a currency swap,<br>A)it may be the

Q59: Your firm's inter-affiliate cash receipts and

Q75: As a mode of FDI entry,cross-border M&A

Q78: The underlying philosophy of the monetary/nonmonetary method