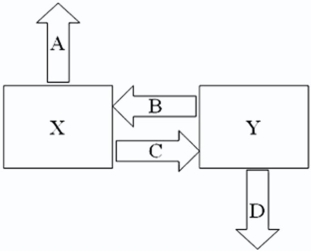

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown here: Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for;

A = Company X's external borrowing rate

B = Company Y's payment to X (rate) C = Company X's payment to Y (rate) D = Company Y's external borrowing rate

A.A = 10%; B = 11.75%; C = LIBOR - .25%; D = LIBOR + 1.5%

B.A = 10%; B = 10%; C = LIBOR - .25%; D = LIBOR + 1.5%

C.A = LIBOR; B = 10%; C = LIBOR - .25%; D = 12%

D.A = LIBOR; B = LIBOR; C = LIBOR - .25%; D = 12%

Definitions:

Office Procedures

Established methods and protocols for handling tasks and operations within an office environment to ensure efficiency and consistency.

Professional Corporation

A type of business entity authorized by state law that is organized for the purpose of providing professional services, such as legal or medical services.

Shareholders

Individuals or entities that own shares in a corporation, giving them certain rights and interests in the company.

Limited Liability

A legal principle where a person's financial risk in a business is restricted to their investment amount.

Q11: Consider the following international investment opportunity: <img

Q16: Consider the situation of firm A

Q18: Edge Act banks are so-called because<br>A)they are

Q43: The key driver of a sovereign's economic

Q46: The exposure coefficient b =

Q59: Approximately _ of wholesale Euro bank external

Q80: In the graph at shown,X and Y

Q83: Suppose that you are a swap

Q86: American Depository Receipt (ADRs)represent foreign stocks<br>A)denominated in

Q92: A U.S.firm holds an asset in