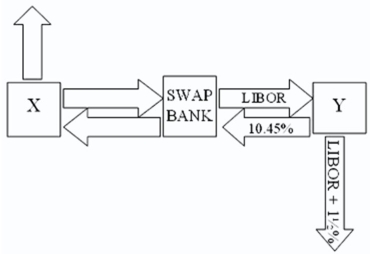

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown below.

A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05 percent -10.45 percent against LIBOR flat.

Assume company Y has agreed,but company X will only agree to the swap if the bank offers better terms.

What are the absolute best terms the bank can offer X,given that it already booked Y?

Definitions:

Budgetary Constraints

Financial limitations that affect the amount of money available for spending.

External Executive Action

Actions taken by external authorities or bodies that influence or dictate the operations and strategies of organizations or entities.

Team Focused Coaching

A leadership method that emphasizes developing and empowering teams through targeted coaching strategies to enhance performance and collaboration.

Principled Leadership

A leadership style that is based on adhering to a set of ethical standards and values while guiding and influencing others.

Q7: Consider the situation of firm A

Q8: Your firm's inter-affiliate cash receipts and

Q18: Your firm is based in southern Ireland

Q19: The United States is the largest initiator,of

Q20: The financial manager's responsibility involves<br>A)increasing the per

Q29: Which investment is likely to be the

Q42: When the Mexican peso collapsed in 1994,declining

Q50: The difference between accounting exposure and translation

Q75: Which will reduce the number of foreign

Q97: Pricing an interest-only single currency swap after