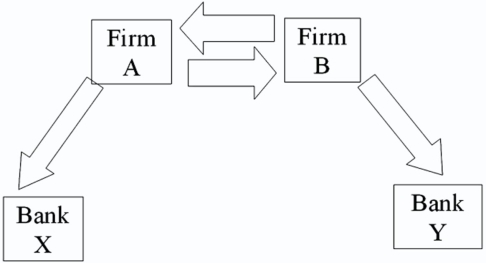

Consider the situation of firm A and firm B.The current exchange rate is $1.50/€.Firm A is a U.S.MNC and wants to borrow €40 million for 2 years.Firm B is a French MNC and wants to borrow $60 million for 2 years.Their borrowing opportunities are as shown; both firms have AAA credit ratings.

Devise a direct swap for A and B that has no swap bank.Show their external borrowing.

Definitions:

Overextension

A language development error in which a child applies a word to more objects than it actually represents, demonstrating an understanding but not precise use of words.

Oversemanticizing

The process of excessively analyzing or interpreting the meanings of words beyond their direct or literal context.

Gestural Language

A form of non-verbal communication using movements of the hands, arms, or body to convey messages.

Auditory Contact

The perception of sounds by the ear or the psychological connection and communication established through hearing.

Q2: Why would a U.S.bank open a foreign

Q13: The "world beta" measures the<br>A)unsystematic risk.<br>B)sensitivity of

Q31: XYZ Corporation,a U.S.parent firm,has a wholly owned

Q34: Under which accounting method are most income

Q43: The key driver of a sovereign's economic

Q55: Calculate the euro-based return an Italian investor

Q61: A U.S.firm holds an asset in

Q62: A type of non-continuous exchange trading system

Q64: The spot exchange rate is ¥125

Q95: Consider a British pound-U.S.dollar dual currency bonds