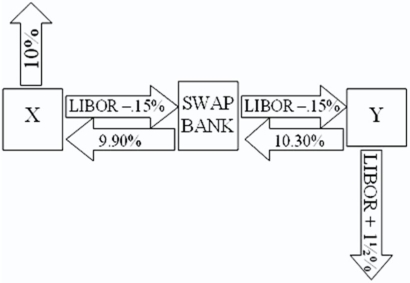

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown here: A swap bank proposes the following interest only swap:

X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR ? 0.15 percent; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90 percent.Y will pay the swap bank interest payments on $10,000,000 at a fixed rate of 10.30 percent and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of LIBOR ? 0.15 percent.  What is the value of this swap to the swap bank?

What is the value of this swap to the swap bank?

Definitions:

Debt

Money that is owed or due to be paid to someone else, typically as loans or bonds.

Time Value

The concept that money available at the present time is worth more than the same amount in the future due to its potential earning capacity.

Option's Market Price

The prevailing price at which an options contract is traded on the market, determined by factors like intrinsic value and time value.

Intrinsic Value

The actual worth of an asset or investment based on its fundamental characteristics, independent of its market value.

Q12: A swap bank has identified two companies

Q22: In an interest-only currency swap<br>A)the counterparties must

Q22: Emerald Energy is an oil exploration and

Q36: Many of the skills necessary for effective

Q43: Solve for the weighted average cost

Q52: The cost of equity capital is<br>A)the expected

Q59: Your firm's inter-affiliate cash receipts and

Q62: Suppose the quote for a five-year swap

Q77: Trade barriers can arise naturally.Which of the

Q85: When exchange rates change,<br>A)U.S.firms that produce domestically