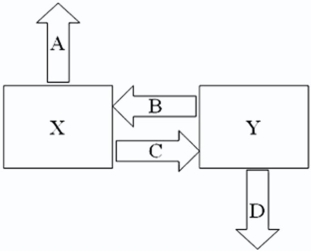

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown here: Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for;

A = Company X's external borrowing rate

B = Company Y's payment to X (rate) C = Company X's payment to Y (rate) D = Company Y's external borrowing rate

A.A = 10%; B = 11.75%; C = LIBOR - .25%; D = LIBOR + 1.5%

B.A = 10%; B = 10%; C = LIBOR - .25%; D = LIBOR + 1.5%

C.A = LIBOR; B = 10%; C = LIBOR - .25%; D = 12%

D.A = LIBOR; B = LIBOR; C = LIBOR - .25%; D = 12%

Definitions:

Extraordinary Gain

A gain that arises from events or transactions that are distinct and infrequent in nature, not expected to recur regularly.

Provision For Inventories

An accounting practice where a reserve is made for potential decreases in the value of a company’s inventory.

Inventories Losses

Reductions in the amount or value of inventories due to factors such as deterioration, obsolescence, or theft, resulting in financial loss.

Lower Of Cost

An accounting principle requiring that the inventory is recorded at the lower of its cost or the current market value.

Q3: The stock market of country A has

Q13: In general,if an investment<br>A)has poor liquidity,it should

Q20: Find the net exposure of the U.S.MNC

Q24: Assume that you have invested $100,000 in

Q46: The required return on equity for an

Q47: In the early 1980s,Honda,the Japanese automobile company,built

Q54: In highly inflationary economies,FASB 52 requires that

Q76: Your firm is based in southern Ireland

Q85: LIBOR<br>A)is the London Interbank Offered Rate.<br>B)is the

Q86: Your firm is in the 34 percent