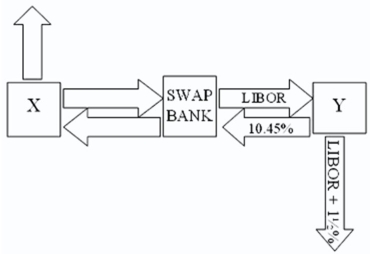

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown below.

A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05 percent -10.45 percent against LIBOR flat.

Assume company Y has agreed,but company X will only agree to the swap if the bank offers better terms.

What are the absolute best terms the bank can offer X,given that it already booked Y?

Definitions:

Economic Life

The estimated period over which an asset is expected to be useful and generate revenue, differing from its physical life.

Off-Balance Sheet Financing

Off-Balance Sheet Financing is a financial obligation that is not directly recorded on the company's balance sheet and is used to keep debt-to-equity ratios low and improve financial indicators.

Operating Expenses

Costs associated with a company's main operational activities, excluding cost of goods sold, financing costs, and taxes.

Income Statement

A financial statement that shows a company's revenues and expenses over a specific period, resulting in the net income or loss for that period.

Q4: Consider the situation of firm A

Q18: With regard to foreign currency translation methods

Q33: Company X wants to borrow $10,000,000

Q43: When a country is more remote,with an

Q54: The sale of new common stock by

Q54: Political risk refers to<br>A)the potential losses to

Q65: A convertible bond pays interest annually at

Q68: A bank may establish a multinational operation

Q75: American Depository Receipt (ADRs)represent foreign stocks<br>A)denominated in

Q79: Compute the payments due in the