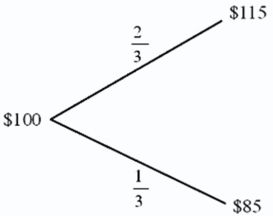

Find the value of a call option written on €100 with a strike price of $1.00 = €1.00.In one period,there are two possibilities: the exchange rate will move up by 15 percent or down by 15 percent .The U.S.risk-free rate is 5 percent over the period.The risk-neutral probability of dollar depreciation is 2/3 and the risk-neutral probability of the dollar strengthening is 1/3.

Definitions:

Total Assets

The sum of all assets owned by a company, including current, non-current, tangible, and intangible assets.

Net Working Capital

A financial measure that illustrates the gap between the current resources of a business and its short-term obligations.

Shareholders' Equity

The residual interest in the assets of a corporation after deducting its liabilities.

Liquid Asset

An asset that can be quickly converted into cash with minimal impact to its value.

Q5: Tobin's Q is<br>A)the ratio of the market

Q6: Proceeding the Asian crisis,<br>A)it may have been

Q18: Your firm has a British customer that

Q31: According to the theory of optimum currency

Q34: Which of the following is a true

Q37: A complete contract between shareholders and managers<br>A)would

Q40: The price-specie-flow mechanism will work only if

Q47: Concentrated corporate ownership is most prevalent in<br>A)Italy.<br>B)the

Q63: FASB 8 is essentially the<br>A)current/noncurrent method.<br>B)monetary/nonmonetary method.<br>C)temporal

Q74: A firm with a highly elastic demand