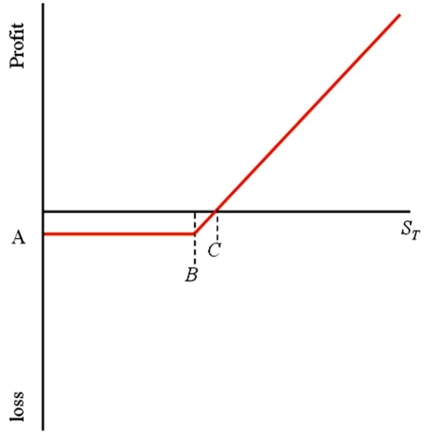

Consider this graph of a call option.The option is a three-month American call option on €62,500 with a strike price of $1.50 = €1.00 and an option premium of $3,125.What are the values of A,B,and C,respectively?

Definitions:

Economic Cost

The total cost of choosing one action over another, including both explicit and implicit costs.

Market Rate of Interest

The prevailing interest rate available in the marketplace on loans, determined by the supply of and demand for funds.

Anti-Employment Discrimination Legislation

Laws designed to prevent unfair treatment of workers based on personal characteristics, such as the Civil Rights Act in the United States.

Q5: The notation is Y = GNP =

Q24: When the domestic currency is strong or

Q34: Which equation is used to define

Q45: Your firm is an Italian exporter of

Q46: A five-year floating-rate note has coupons referenced

Q50: The firm may not be able to

Q54: The Eurobond segment of the international bond

Q63: A U.S.-based currency dealer has good credit

Q63: Continued U.S.trade deficits coupled with foreigners' desire

Q82: When a country's currency depreciates against the