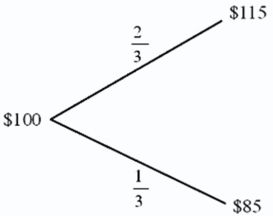

Find the value of a call option written on €100 with a strike price of $1.00 = €1.00.In one period,there are two possibilities: the exchange rate will move up by 15 percent or down by 15 percent .The U.S.risk-free rate is 5 percent over the period.The risk-neutral probability of dollar depreciation is 2/3 and the risk-neutral probability of the dollar strengthening is 1/3.

Definitions:

General Partners

are owners of a partnership who bear unlimited liability for the debts and obligations of the business.

Expelled

The act of being officially removed or barred from an institution or organization.

Overbilling

The practice of charging more than the agreed price or more than the services or goods provided are worth, often considered fraudulent or unethical.

Peanut Allergy

An allergic reaction that occurs when the body's immune system mistakenly identifies peanut proteins as harmful, leading to potentially severe symptoms.

Q4: When Interest Rate Parity (IRP)does not hold<br>A)there

Q7: Consider the position of a treasurer of

Q43: The major legislation controlling the operation of

Q61: Generally speaking,<br>A)it is not possible to hedge

Q76: Proceeding the Asian crisis,<br>A)domestic price bubbles in

Q83: In conversation,interbank foreign exchange traders use a

Q87: English common law countries tend to provide

Q91: Which of the following would not count

Q92: If a country must make a net

Q97: Your firm is an Italian importer of