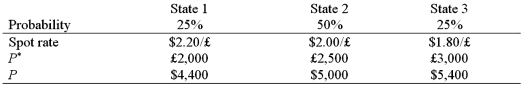

A U.S. firm holds an asset in Great Britain and faces the following scenario:  where,

where,

P* = Pound sterling price of the asset held by the U.S. firm

P = Dollar price of the same asset

-The expected value of the investment in U.S. dollars is

Definitions:

Accrued Interest

Interest that has accumulated over time but has not yet been paid by the borrower.

Beneath Face Value

Refers to when a security is trading for less than its nominal or face value.

Premium on Bonds

The amount by which the price paid for a bond exceeds its face value, often due to interest rates being lower than the bond's coupon rate.

Interest Method

A technique used in accounting and finance to calculate the interest between periods based on principal, rate, and time.

Q1: Find the hedge ratio for a call

Q2: Another term Hofstede uses to describe long-term

Q7: _ was the world's leading manufacturing country

Q13: A purely domestic firm that sources and

Q31: Find the no-arbitrage cross exchange rate.The dollar-euro

Q35: The major globalization drivers include all of

Q40: International business really began<br>A)with the East India

Q41: Most foreign exchange transactions are for<br>A)intervention by

Q46: The same call from the last question

Q63: Formal institutions operate through laws and regulations.They