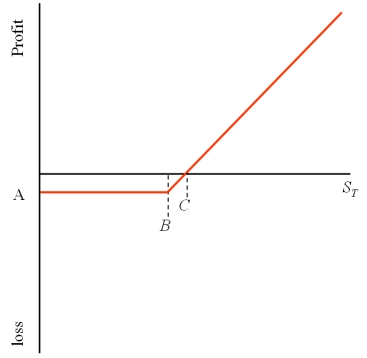

Consider the graph of a call option shown at right.The option is a three-month American call option on €62,500 with a strike price of $1.50 = €1.00 and an option premium of $3,125.What are the values of A,B,and C,respectively?

Definitions:

Current Assets

Assets that are expected to be converted into cash, sold, or consumed within one year or the business's operating cycle, whichever is longer.

Q22: USING YOUR PREVIOUS ANSWERS and a bit

Q25: Your firm is a U.S.-based exporter of

Q31: An exporter can shift exchange rate risk

Q35: Consider a U.S.-based MNC with a wholly-owned

Q47: Free cash flow refers to<br>A)a firm's cash

Q50: You are a U.S.-based treasurer with $1,000,000

Q65: The difference between Foreign Direct Investment and

Q71: Consider a U.S.-based MNC with a wholly-owned

Q75: Find the no-arbitrage cross exchange rate.The dollar-euro

Q89: Suppose you observe the following exchange rates: