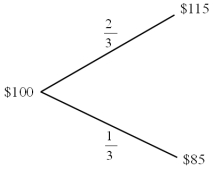

Find the value of a call option written on €100 with a strike price of $1.00 = €1.00.In one period there are two possibilities: the exchange rate will move up by 15% or down by 15% .The U.S.risk-free rate is 5% over the period.The risk-neutral probability of dollar depreciation is 2/3 and the risk-neutral probability of the dollar strengthening is 1/3.

Definitions:

Implicit Interest Rate

An interest rate inferred from the cost of borrowing, or the return on investment, that is not explicitly stated.

AASB 16

The Australian Accounting Standards Board standard on leases, which outlines the principles for recognition, measurement, presentation, and disclosure of leases.

IFRS 16

The International Financial Reporting Standard dictating lease accounting, requiring lessees to recognize nearly all leases on the balance sheet.

Lease Agreements

Contracts that outline the terms under which one party agrees to rent property owned by another party.

Q3: Fundamentally,there are two types of tax jurisdiction:<br>A)The

Q7: Yesterday,you entered into a futures contract to

Q9: Financial development can contribute to economic growth

Q15: Discuss the three environments in which an

Q16: The exposure coefficient <span class="ql-formula"

Q40: Which of the following are correct?<br>A)

Q46: A withholding tax<br>A)is borne by a taxpayer

Q52: Identify and discuss the 5 major kinds

Q72: The international environment is the interactions between<br>A)the

Q88: An international company is an organization with