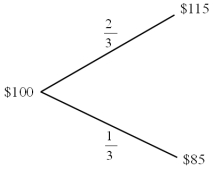

Find the value of a call option written on €100 with a strike price of $1.00 = €1.00.In one period there are two possibilities: the exchange rate will move up by 15% or down by 15% .The U.S.risk-free rate is 5% over the period.The risk-neutral probability of dollar depreciation is 2/3 and the risk-neutral probability of the dollar strengthening is 1/3.

Definitions:

Average Variable Costs

Average variable costs represent the per-unit variable costs of production, calculated by dividing total variable costs by the quantity of output.

Average Fixed Costs

Average fixed costs refer to the fixed costs of production (costs that do not change with the level of output) divided by the quantity of output produced, which decreases as output increases.

Total Cost

The entire production cost, comprising both unchanging and variable expenditures.

Diminishing Marginal Product

A principle stating that as additional units of a variable input are added to a fixed input, the additional output produced by each new unit will eventually decline.

Q7: _ was the world's leading manufacturing country

Q9: The WTO has made progress on trade-related

Q10: Adam Smith claimed:<br>A)that governments,not market forces,should determine

Q22: The capital account is divided into three

Q27: Consider the balance sheets of Bank A

Q29: In many countries with concentrated ownership<br>A)the conflicts

Q35: In evaluating the pros and cons of

Q37: In the Interbank market,the standard size of

Q50: A study of Fortune 500 firms hedging

Q91: Under the fixed exchange rate regime<br>A)the combined