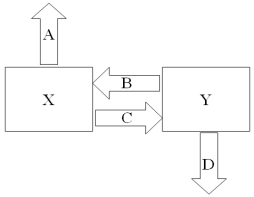

Company X wants to borrow $10,000,000 floating for 5 years.Company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are: Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for A = Company X's external borrowing rate

B = Company Y's payment to X (rate)

C = Company X's payment to Y (rate)

D = Company Y's external borrowing rate

Definitions:

Long-term Care Insurance

Insurance coverage designed to cover the costs of long-term care services, including both medical and non-medical needs for people with a chronic illness or disability.

Health Insurance Market

A market that deals with the selling and buying of health insurance policies, facilitating coverage for medical expenses.

Adverse Selection

A situation in which one party in a transaction possesses information that the other party does not, leading to an imbalance in the transaction that can result in market inefficiency.

Asymmetric Information

A situation in which one party in a transaction has more or superior information compared to another. This can lead to an imbalance in power and potentially unfair transactions.

Q8: Calculate the euro-based return an Italian investor

Q11: Find the net cash flow for the

Q19: What is CF5 in dollars?

Q35: In highly inflationary economies,FASB 52 requires that

Q36: A specialist on the NYSE<br>A)is obliged to

Q39: Micro Spinoffs,Inc.,issued 20-year debt one year ago

Q55: Since the end of World War I,the

Q65: Which of the following statements is true

Q85: A "primary" stock market is<br>A)a big internationally-important

Q98: Underwriters for an international bond issue will