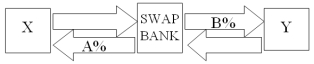

Company X wants to borrow $10,000,000 floating for 1 year; company Y wants to borrow £5,000,000 fixed for 1 year.The spot exchange rate is $2 = £1 and IRP calculates the one-year forward rate as $2.00*(1.08) /£1.00*(1.06) = $2.0377/£1.Their external borrowing opportunities are: A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap.In order for X and Y to be interested,they can face no exchange rate risk  What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

Definitions:

Revenue Accounts

Accounts that track the income earned from the sale of goods and services, or the increase in equity resulting from the operations of an organization.

Owner's Capital Account

An account on a company's balance sheet that represents the owner's invested capital plus retained earnings minus withdrawals.

Balance Sheet Accounts

Accounts that reflect the financial position of a company at a specific point in time, including assets, liabilities, and shareholders' equity.

Closing Entry Process

The procedure used at the end of an accounting period to transfer balances from temporary accounts to permanent accounts, clearing the temporary accounts for the next period.

Q5: The "reporting currency" is defined in FASB

Q44: The "world beta" measures the<br>A)unsystematic risk.<br>B)sensitivity of

Q49: Market makers in the secondary bond market<br>A)stand

Q51: In the 1960s,Coca-Cola,which had bottling plants in

Q76: In the London market,Rolls-Royce stock closed at

Q78: LIBOR<br>A)is the London Interbank Offered Rate.<br>B)is the

Q83: Find the net cash flow in (out

Q83: Today is January 1,2009.The state of Iowa

Q93: What is the NPV of the project

Q98: Suppose the domestic U.S.beta of IBM