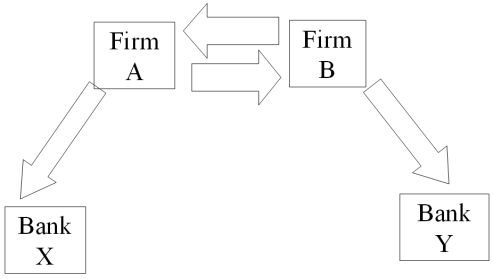

Devise a direct swap for A and B that has no swap bank.Show their external borrowing.Answer the problem in the template provided.

Definitions:

Floating-rate Debt

A form of borrowing where the interest rate fluctuates over time based on a benchmark or index rate.

Derivative Instrument

A financial contract whose value is derived from the performance of underlying assets, indices, or interest rates.

Forward Contract

A customized contract between two parties to buy or sell an asset at a specified price on a future date.

Extinguishment Of Debt

The process of fully paying off debt obligations, through payment, refinancing, or restructuring, effectively removing them from the company's balance sheet.

Q11: Find the IRR in euro for the

Q25: Using the APV method,what is the value

Q28: A highly inflationary economy is defined in

Q35: In a dealer market,the broker takes the

Q38: Recent studies suggest that agency costs of

Q68: The underlying principle of the current rate

Q80: WEBS are<br>A)World Equity Benchmark Shares.<br>B)exchange-traded open-end country

Q96: A zero-coupon Japanese bond promises to pay

Q99: Since SR < AR,then<br>A)ABC Bank will pay

Q100: Regarding the mechanics of international portfolio diversification,which