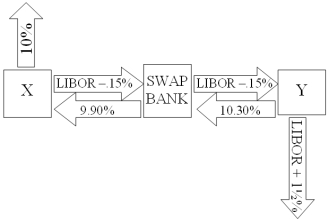

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown below: A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90%.Y will pay the swap bank interest payments on $10,000,000 at a fixed rate of 10.30% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%.  What is the value of this swap to the swap bank?

What is the value of this swap to the swap bank?

Definitions:

Aversive Conditioning

A method of behavior modification that involves using unpleasant stimuli to discourage undesirable behaviors.

Classical Conditioning

A method of conditioning in which the pairing of two stimuli results in a response initially elicited by the second stimulus being evoked by the first stimulus after repeated associations.

Mary Cover Jones

Mary Cover Jones was a pioneering American psychologist known for her work in behavior therapy and for conducting early studies on the desensitization of phobias.

Ice-Cream

A sweet, frozen dessert made from cream or milk and sugar, often flavored with fruits, chocolate, or nuts.

Q13: Act as a swap bank and quote

Q33: Assuming that the interaffiliate cash flows

Q37: Which combination of the following statements is

Q60: Find the debt-to-value ratio for a firm

Q61: What is CF1 in dollars?

Q68: A measure of liquidity for a stock

Q81: The primary activities of offshore banks<br>A)include money

Q88: U.S.-based mutual funds known as country funds.<br>A)Invest

Q88: Find the debt-to-equity ratio for a firm

Q100: FDI can take the form of<br>A)Greenfield investment.<br>B)cross-border